All Categories

Featured

Table of Contents

This is despite whether the guaranteed individual passes away on the day the plan begins or the day before the policy ends. In other words, the quantity of cover is 'level'. Legal & General Life Insurance Policy is an example of a degree term life insurance policy plan. A degree term life insurance policy plan can suit a large range of conditions and needs.

Your life insurance policy plan can also develop component of your estate, so might be subject to Inheritance Tax learnt more concerning life insurance policy and tax obligation - Term life insurance with level premiums. Let's look at some features of Life insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life insurance policy), or 67 (with Crucial Health Problem Cover)

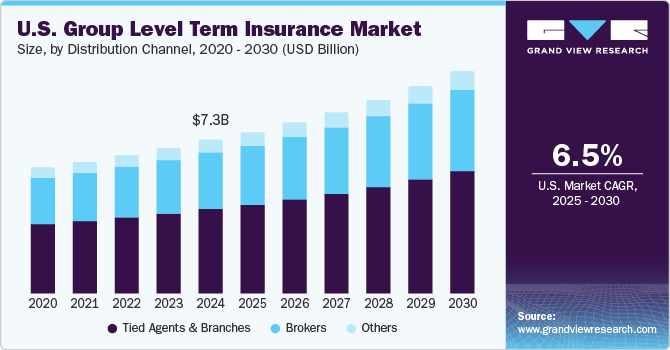

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - best life insurance plans in 2025 from brokers". Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

The amount you pay remains the exact same, but the degree of cover lowers roughly in line with the means a repayment home loan decreases. Lowering life insurance can help your liked ones remain in the household home and stay clear of any type of additional disturbance if you were to pass away.

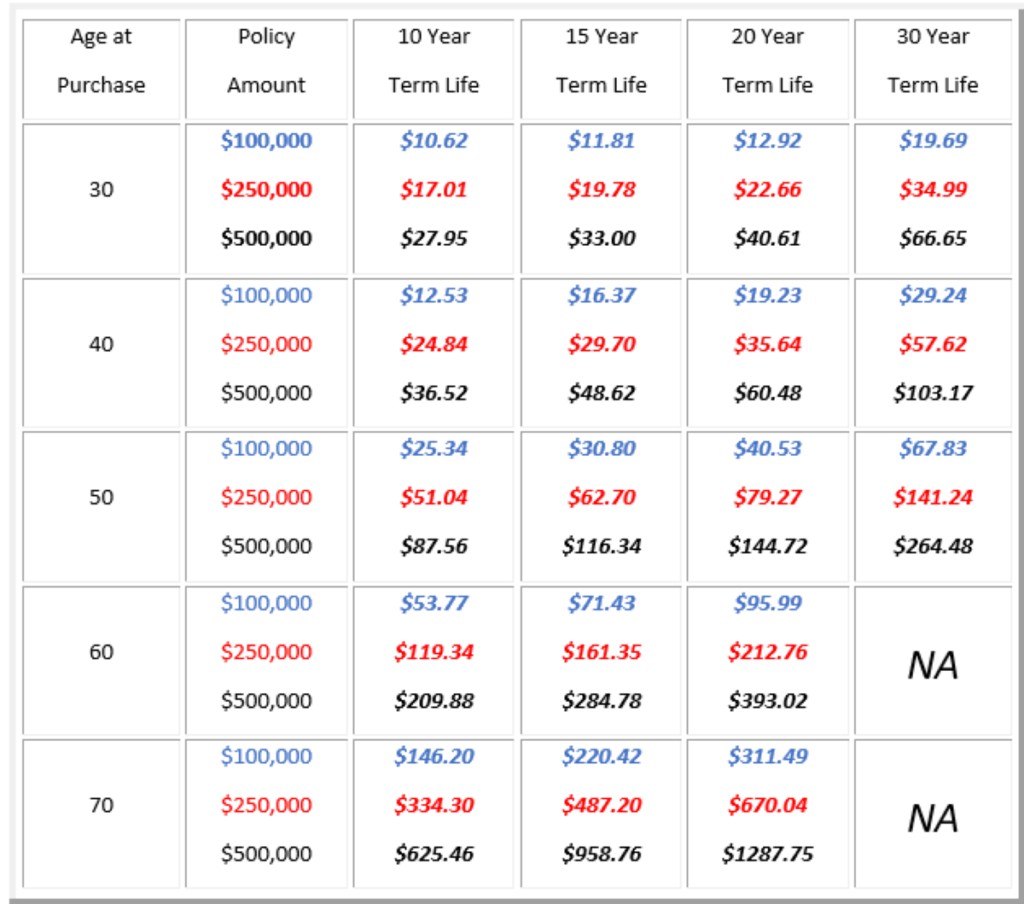

If you select level term life insurance policy, you can allocate your premiums since they'll remain the exact same throughout your term. Plus, you'll know specifically just how much of a fatality advantage your recipients will certainly receive if you die, as this quantity will not transform either. The rates for degree term life insurance policy will rely on a number of variables, like your age, health condition, and the insurance coverage firm you select.

Once you undergo the application and clinical examination, the life insurance policy company will certainly assess your application. They need to inform you of whether you have actually been authorized shortly after you use. Upon approval, you can pay your initial premium and authorize any appropriate documents to guarantee you're covered. From there, you'll pay your premiums on a monthly or yearly basis.

What Is Term Life Insurance Level Term? The Complete Overview?

You can select a 10, 20, or 30 year term and appreciate the added tranquility of mind you are worthy of. Functioning with a representative can help you find a policy that works best for your demands.

As you try to find ways to protect your monetary future, you have actually most likely encountered a wide range of life insurance options. Picking the right insurance coverage is a big decision. You wish to discover something that will assist support your loved ones or the reasons essential to you if something happens to you.

What Is 30-year Level Term Life Insurance? The Complete Overview?

Lots of people favor term life insurance coverage for its simplicity and cost-effectiveness. Term insurance coverage contracts are for a fairly short, specified time period however have alternatives you can tailor to your needs. Specific benefit choices can make your costs change over time. Level term insurance, nonetheless, is a kind of term life insurance that has regular payments and an unchanging.

Level term life insurance policy is a subset of It's called "degree" because your premiums and the benefit to be paid to your enjoyed ones remain the same throughout the agreement. You won't see any kind of changes in cost or be left questioning its value. Some agreements, such as each year sustainable term, might be structured with costs that enhance with time as the insured ages.

They're figured out at the beginning and stay the same. Having consistent repayments can aid you far better strategy and budget plan due to the fact that they'll never change. Repaired survivor benefit. This is additionally established at the beginning, so you can recognize specifically what death advantage quantity your can expect when you die, as long as you're covered and up-to-date on costs.

This typically between 10 and 30 years. You accept a fixed costs and death advantage throughout of the term. If you pass away while covered, your fatality advantage will certainly be paid to liked ones (as long as your costs depend on day). Your beneficiaries will certainly recognize ahead of time just how much they'll get, which can assist for intending purposes and bring them some economic safety and security.

What is Guaranteed Level Term Life Insurance? Explained in Detail

You may have the option to for one more term or, most likely, restore it year to year. If your contract has an assured renewability condition, you may not require to have a brand-new medical examination to maintain your protection going. Your costs are likely to increase since they'll be based on your age at renewal time.

With this choice, you can that will certainly last the rest of your life. In this situation, once again, you might not require to have any kind of brand-new medical examinations, but premiums likely will rise because of your age and new protection (Term life insurance for couples). Various firms use various choices for conversion, make sure to understand your selections before taking this action

Talking with a financial expert also may assist you identify the course that lines up best with your general strategy. The majority of term life insurance policy is level term throughout of the agreement duration, but not all. Some term insurance policy might feature a costs that rises over time. With reducing term life insurance policy, your fatality benefit goes down gradually (this kind is frequently gotten to especially cover a lasting financial obligation you're settling).

And if you're established up for sustainable term life, then your costs likely will rise yearly. If you're discovering term life insurance policy and intend to make certain straightforward and predictable financial defense for your household, degree term may be something to take into consideration. However, just like any type of sort of insurance coverage, it might have some constraints that do not fulfill your demands.

What is the Advantage of 20-year Level Term Life Insurance?

Commonly, term life insurance policy is much more budget friendly than irreversible protection, so it's an affordable means to safeguard financial protection. At the end of your agreement's term, you have multiple options to continue or move on from coverage, usually without needing a medical exam.

Similar to other sort of term life insurance policy, once the agreement ends, you'll likely pay greater premiums for insurance coverage due to the fact that it will certainly recalculate at your existing age and health. Repaired insurance coverage. Degree term supplies predictability. If your financial circumstance modifications, you might not have the needed coverage and may have to purchase extra insurance coverage.

That does not suggest it's a fit for everyone. As you're purchasing life insurance policy, below are a couple of essential factors to take into consideration: Spending plan. One of the advantages of level term protection is you understand the price and the death advantage upfront, making it easier to without worrying regarding boosts over time

Age and health and wellness. Generally, with life insurance policy, the healthier and younger you are, the more cost effective the protection. If you're young and healthy and balanced, it might be an attractive option to lock in low costs currently. Financial duty. Your dependents and economic responsibility contribute in determining your insurance coverage. If you have a young family, as an example, level term can aid supply financial backing throughout essential years without spending for protection much longer than needed.

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Best Company To Sell Final Expense Insurance For

Best Life Insurance To Cover Funeral Expenses