All Categories

Featured

Table of Contents

No matter when you pass away, your heirs will certainly get the death advantage you want them to have, as long as you paid the premiums. Last cost insurance coverage may not suffice to cover every little thing however it can assist your enjoyed ones pay at the very least some bills straight. These might be costs they 'd otherwise have a tough time managing.

Last cost insurance policy can eliminate the concerns of your member of the family since it offers them with cash they may require to pay expenses associated with your death. It can be a welcome selection for people that can't get any various other insurance as a result of their age or health however desire to relieve some economic problems for enjoyed ones.

For more on ensured problem policies, consisting of exactly how life insurance policy firms can afford to offer them, read our item on guaranteed issue life insurance policy. There's a 3rd kind of final expenditure insurance. It's a rated advantage policy with a partial waiting period. This kind of policy could pay 30% to 40% of the death advantage if the insured passes away throughout the very first year the policy is in pressure.

Senior Care Usa Final Expense

If the insured passes away after those initial two years, after that the plan would pay out 100% of the fatality advantage. If you have health and wellness conditions that are only semi-serious, you might get a graded advantage policy as opposed to an assured concern policy. These health problems consist of getting in remission from cancer in the last 24 months, heart disease, or treatment for alcohol or substance abuse in the last 24 months.

With that said policy, you'll have to wait a minimum of two years for any kind of coverage. No solitary insurer supplies the very best final expense insurance solution, claims Martin. It's essential to get deals from multiple insurance policy firms to find the ones that view your wellness most favorably. Those business will likely supply you the very best rates.

State Regulated Program For Final Expenses

Even if you have a less-than-ideal response to a health question, it does not suggest every firm will certainly reject you. Some may supply you prompt insurance coverage with higher costs, a rated advantage plan, or an assured concern policy. Investopedia/ Lara Antal If you have significant financial savings, investments, and regular life insurance policy, then you possibly do not need final expenditure insurance.

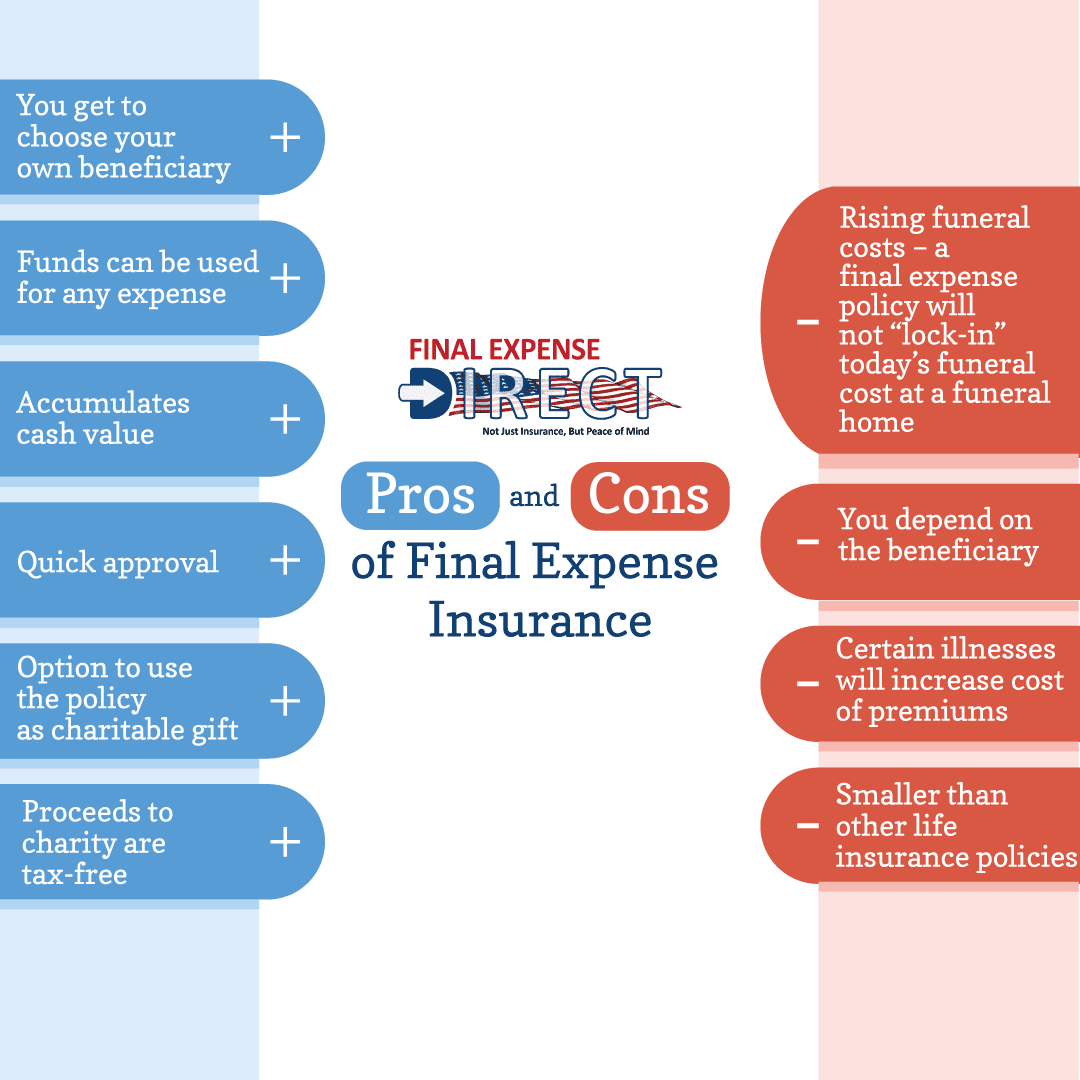

Fatality benefit can't be decreased unless you borrow versus cash value or request accelerated death advantages throughout your lifetime. Successors can utilize fatality benefit for any purpose. Fatality benefit is guaranteed as long as costs are paid and you don't have a term plan.

If he acquires the most pricey policy with the $345 month-to-month premium, after two years he will certainly have paid $8,280 in costs. His beneficiaries will certainly appear in advance if he passes away in between the very first day of year 3 (when the waiting period ends) and completion of year six, when the costs paid will be about equivalent to the survivor benefit.

They may not even want to purchase a final expenditure plan, according to Sabo. Sabo says that a 68-year-old non-smoking male in California might get a $25,000 ensured universal life plan for about $88 per month.

Surefire global life, like entire life, does not end as long as you acquire a plan that covers the rest of your life. You can acquire a plan that will cover you to age 121 for optimal defense, or to age 100, or to a younger age if you're trying to save money and don't require protection after, say, age 90.

Final Expense Insurance Florida

Anything. An insured might have meant that it be made use of to pay for things like a funeral, blossoms, medical expenses, or retirement home expenses. The money will certainly belong to the recipient, that can decide to utilize it for something else, such as credit card debt or a nest egg.

The majority of websites using it have calculators that can provide you an idea of expense. For illustrative purposes, a 65 year-old woman looking for a $10,000 face amount and no waiting duration might pay concerning $41 monthly. For a guaranteed acceptance plan, they would certainly pay $51. A 65 year-old man looking for a $10,000 face quantity and no waiting period might pay concerning $54 monthly, and $66 for guaranteed acceptance.

If you have actually sufficient cash alloted to cover the expenditures that must be satisfied after you die, after that you do not need it. Nonetheless numerous individuals are not aware of the high (and expanding) expense of funeral services. Or that a medical facility might offer them with big, unforeseen costs. If you don't have money for these and various other linked expenditures, or normal insurance coverage that can cover assist them, last cost insurance coverage can be an actual advantage to your family.

Funeral Insurance Jobs

It can be used to spend for the numerous, conventional services they want to have, such as a funeral or memorial service. Financial cost insurance is very easy to receive and affordable. Protection amounts range from $2,000 up to $35,000. It isn't a significant quantity however the benefit can be a godsend for member of the family without the monetary wherewithal to satisfy the costs connected with your death.

Final Expenditure Insurance (aka funeral or burial insurance coverage) is suggested to cover the bills that your enjoyed ones will certainly confront after you die, including funeral costs and clinical bills. At Final Expenditure Direct, we represent our customers with their finest rate of interest in mind, everyday. Our group is below to answer your concerns about last cost insurance.

It appears sensible to conserve money to use for your last expenditures. You could have to reach into that cash before you pass away. There's no way to recognize for certain due to the fact that illness, injuries, and illnesses are unpredictable. Likewise, clinical financial debt is the # 1 source of personal bankruptcy in this country.

With pre-need insurance, the payment goes straight to the funeral home.

We suggest obtaining three final expense quotes. Prices aren't marketed online, so you'll require to call the funeral home straight. We feel like contrasting 3 is enough to provide you a basic idea. You ought to get as numerous as it takes to feel comfy that you're getting the finest cost or solution for your budget.

Funeral Plans With No Waiting Period

You can do this in four easy actions: To approximate your family members's expenses, take the amount of a normal month's expenses (include energies, automobile expenses, house settlements, food and transport, insurance coverage charges, and so on) and multiply the overall by 3. This will certainly be about what your household needs to make it through for a few months.

Funeral expenses are dictated by what kind of services you select. See this checklist to assist obtain a precise estimate of the typical funeral-related costs. We can presume, at this moment, that your costs will balance $10,000. Next, add the above numbers together. In this case, it's $9,000 (family expenses) + $10,000 (funeral service expenses) = $19,000.

Finally, there's an inflation element that varies for men and ladies. This variable depends upon your age range. For men ages 63-65, the multiplier is 1.83. You 'd increase 1.83 by the complete you had from Step 3 for the total approximated cost. Compare and buyfinal expense You can attempt to make funeral setups with your will, but don't expect trusted outcomes.

Chances are slim that your will would supply any prompt aid with your last costs. You might wonder if you require last expenditure insurance if you're an expert.

State Insurance Funeral Cover

With an adaptable last expense plan, you can fill in the gaps. Medicaid and Social Safety advantages hardly start to cover last expenditures.

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Best Company To Sell Final Expense Insurance For

Best Life Insurance To Cover Funeral Expenses