All Categories

Featured

Table of Contents

Home loan life insurance policy gives near-universal coverage with minimal underwriting. There is usually no medical checkup or blood example required and can be an important insurance plan option for any type of property owner with severe pre-existing medical problems which, would certainly stop them from acquiring traditional life insurance policy. Other advantages include: With a home loan life insurance policy policy in position, beneficiaries will not need to fret or question what might occur to the family members home.

With the mortgage settled, the family will constantly belong to live, offered they can manage the real estate tax and insurance coverage annually. life insurance to buy a house.

There are a few various kinds of mortgage defense insurance, these consist of:: as you pay more off your mortgage, the quantity that the plan covers decreases according to the superior equilibrium of your mortgage. It is one of the most usual and the least expensive form of home loan protection - homeowners insurance death benefits.: the quantity guaranteed and the costs you pay continues to be degree

This will certainly pay off the mortgage and any type of staying balance will certainly go to your estate.: if you wish to, you can add serious illness cover to your mortgage defense policy. This means your home mortgage will be gotten rid of not only if you die, however also if you are identified with a significant ailment that is covered by your plan.

Mortgage Protection Plus

In addition, if there is an equilibrium staying after the home mortgage is gotten rid of, this will most likely to your estate. If you alter your home mortgage, there are numerous points to think about, relying on whether you are covering up or extending your mortgage, switching, or paying the home mortgage off early. If you are topping up your mortgage, you require to make certain that your plan satisfies the new worth of your mortgage.

Compare the prices and benefits of both options (mortgage life insurance ontario). It might be less expensive to maintain your initial mortgage security plan and after that purchase a 2nd plan for the top-up amount. Whether you are topping up your mortgage or extending the term and need to obtain a brand-new plan, you may locate that your costs is higher than the last time you took out cover

Why Do You Have To Have Mortgage Insurance

When changing your mortgage, you can designate your home mortgage defense to the new lender. The costs and degree of cover will certainly coincide as before if the amount you obtain, and the regard to your mortgage does not alter. If you have a policy via your lender's team scheme, your lender will certainly cancel the policy when you switch your mortgage.

In California, home loan defense insurance coverage covers the whole superior balance of your car loan. The fatality benefit is an amount equal to the balance of your home loan at the time of your death.

Insurance On Home Loan

It's important to recognize that the fatality advantage is given directly to your financial institution, not your liked ones. This ensures that the continuing to be debt is paid in full which your loved ones are spared the economic strain. Home loan protection insurance policy can likewise supply temporary protection if you become handicapped for a prolonged duration (generally six months to a year).

There are numerous advantages to obtaining a home loan security insurance coverage policy in California. A few of the leading benefits consist of: Ensured approval: Even if you're in bad wellness or work in a harmful profession, there is guaranteed authorization without any medical examinations or lab examinations. The exact same isn't true forever insurance.

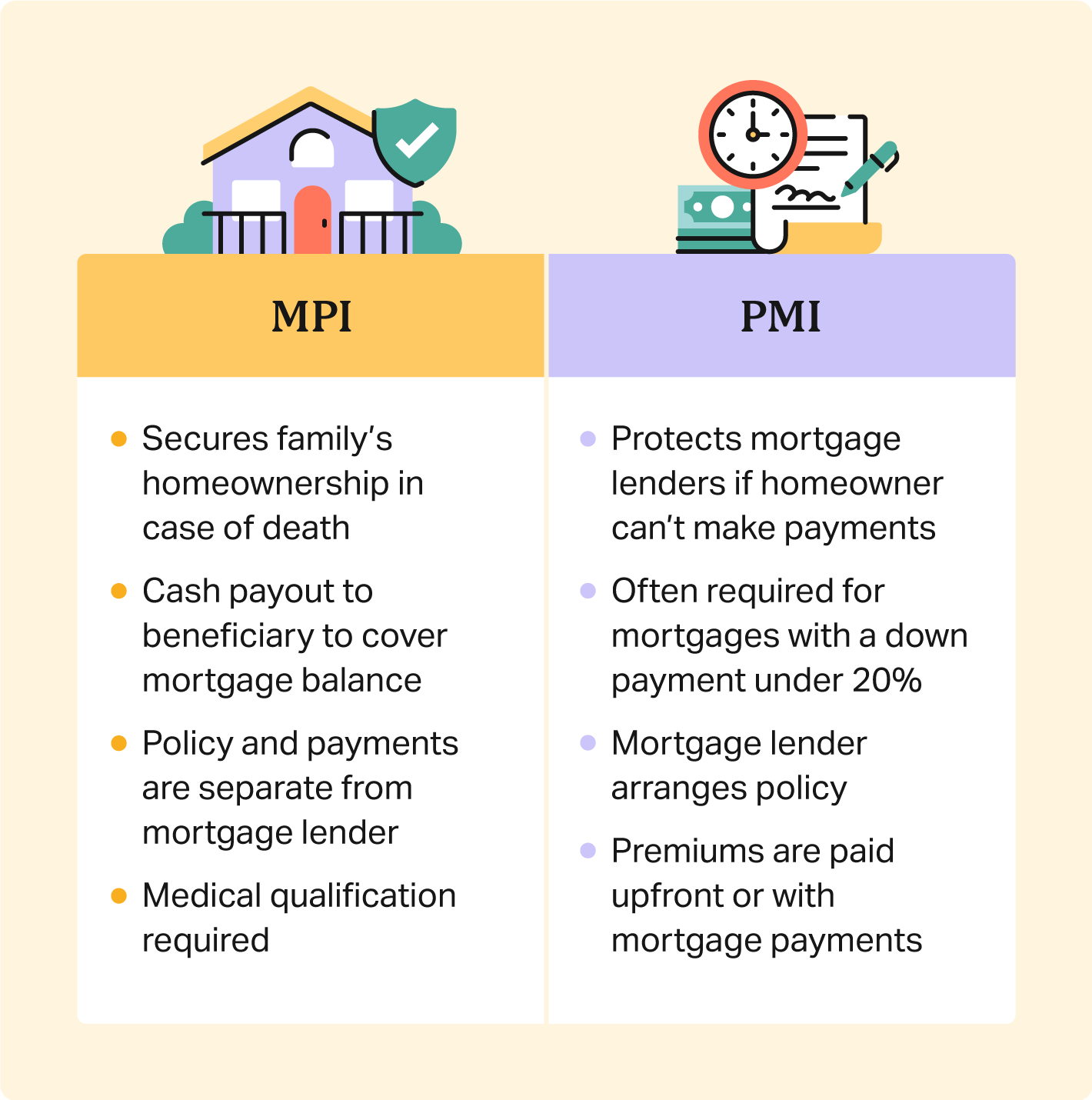

Disability protection: As mentioned over, some MPI policies make a couple of home mortgage payments if you come to be impaired and can not bring in the same earnings you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all various sorts of insurance coverage. Mortgage security insurance (MPI) is developed to pay off a home mortgage in situation of your death.

Is It Mandatory To Have Life Insurance With A Mortgage

You can also use online in minutes and have your policy in position within the same day. For additional information about getting MPI protection for your home funding, contact Pronto Insurance today! Our knowledgeable representatives are here to address any questions you may have and give further aid.

MPI uses several advantages, such as tranquility of mind and simplified credentials procedures. The death benefit is directly paid to the loan provider, which limits versatility - mortgage and insurance. Furthermore, the benefit quantity lowers over time, and MPI can be more costly than typical term life insurance coverage policies.

Home Mortgage Protection Insurance

Go into fundamental details concerning yourself and your home mortgage, and we'll compare rates from various insurers. We'll also show you just how much protection you need to protect your home mortgage. So get going today and provide yourself and your household the satisfaction that features knowing you're secured. At The Annuity Expert, we comprehend homeowners' core issue: ensuring their family members can preserve their home in the event of their death.

The main benefit right here is clearness and confidence in your choice, knowing you have a plan that fits your needs. As soon as you accept the strategy, we'll manage all the paperwork and setup, guaranteeing a smooth execution procedure. The favorable result is the assurance that features recognizing your family members is protected and your home is protected, no issue what happens.

Specialist Suggestions: Support from knowledgeable experts in insurance and annuities. Hassle-Free Configuration: We deal with all the documentation and application. Cost-Effective Solutions: Discovering the most effective protection at the most affordable feasible cost.: MPI specifically covers your mortgage, supplying an extra layer of protection.: We work to discover one of the most cost-efficient solutions customized to your spending plan.

They can give details on the coverage and benefits that you have. Generally, a healthy and balanced individual can expect to pay around $50 to $100 each month for mortgage life insurance policy. It's suggested to acquire an individualized home mortgage life insurance coverage quote to get an exact estimate based on specific circumstances.

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Best Company To Sell Final Expense Insurance For

Best Life Insurance To Cover Funeral Expenses