All Categories

Featured

Table of Contents

Life insurance representatives sell home loan protection and lending institutions market home loan protection insurance, at some point. mortgage protection insurance cover. Below are the 2 kinds of representatives that market home loan defense (largest mortgage insurance companies).

Getting mortgage defense with your lending institution is not constantly a simple task, and many times rather complicated. It is possible. Lenders generally do not offer home loan protection that benefits you. affordable mortgage protection. This is where things get confusing. Lenders market PMI insurance coverage which is designed to protect the lending institution and not you or your family members.

Mortgage Protection Critical Illness

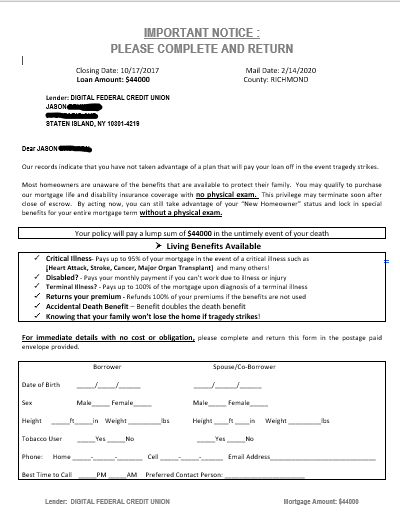

The letters you receive show up to be originating from your loan provider, however they are just originating from 3rd party business. mortgage protection usa. If you don't wind up getting typical home mortgage protection insurance coverage, there are various other kinds of insurance coverage you might been required to have or could intend to take into consideration to secure your financial investment: If you have a home mortgage, it will be needed

Specifically, you will certainly want home protection, components protection and personal responsibility. mis sold mortgage insurance. On top of that, you must consider adding optional protection such as flooding insurance policy, earthquake insurance, substitute cost plus, water back-up of drain, and various other structures insurance for this such as a gazebo, lost or unattached garage. Just as it appears, fire insurance coverage is a type of residential or commercial property insurance policy that covers damage and losses triggered by fire

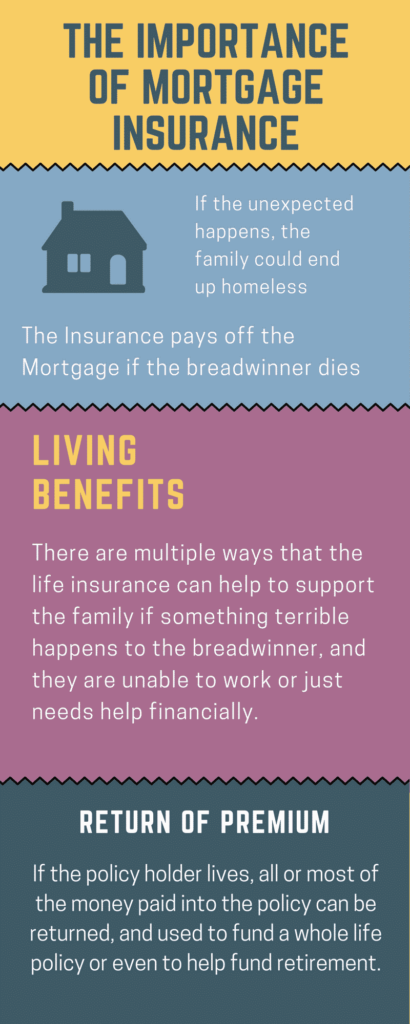

This is the main alternative to MPI insurance policy. A term plan can be structured for a particular term that pays a lump amount upon your fatality which can be utilized for any type of objective, including settling your home mortgage. Entire life is a long-term plan that is much more pricey than term insurance yet lasts throughout your entire life.

Protection is typically limited to $25,000 or less, but it does protect versus having to touch various other financial resources when an individual dies (low cost mortgage home protection program). Final expense life insurance policy can be utilized to cover clinical prices and various other end-of-life costs, consisting of funeral service and burial costs. It is a type of permanent life insurance policy that does not end, but it is an extra expensive that term life insurance coverage

Ppi Mortgage Insurance

Some funeral homes will certainly approve the project of a final cost life insurance policy plan and some will not. Some funeral homes need payment in advance and will certainly not wait till the last cost life insurance coverage policy pays out. It is best to take this into factor to consider when dealing when thinking about a final expenditure in.

You have numerous alternatives when it comes to acquiring home mortgage security insurance. Among these, from our perspective and experience, we have actually located the complying with business to be "the best of the finest" when it comes to issuing mortgage protection insurance coverage policies, and recommend any kind of one of them if they are options presented to you by your insurance agent or home loan lender.

Lenders Mortgage Insurance Providers

Can you get home loan defense insurance policy for homes over $500,000? The most significant distinction in between home mortgage defense insurance coverage for homes over $500,000 and homes under $500,000 is the need of a medical exam.

Every company is different, yet that is a great general rule. With that said, there are a few companies that use home loan security insurance policy approximately $1 million without clinical exams. mortgage protect insurance. If you're home deserves less than $500,000, it's highly likely you'll get strategy that doesn't call for medical examinations

Home loan defense for reduced revenue housing typically isn't needed as the majority of reduced revenue housing devices are rented and not possessed by the resident. The proprietor of the systems can definitely purchase mortgage defense for low revenue real estate system tenants if the plan is structured appropriately. In order to do so, the homeowner would need to deal with an independent representative than can structure a team strategy which allows them to consolidate the occupants on one plan.

If you have inquiries, we highly recommend speaking with Drew Gurley from Redbird Advisors. Drew Gurley belongs to the Forbes Finance Council and has actually worked several of one of the most special and diverse home mortgage protection strategies - life insurance property. He can definitely aid you think through what is required to put this sort of plan together

Takes the uncertainty out of protecting your home if you pass away or come to be handicapped. Money goes right to the mortgage firm when an advantage is paid out.

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Best Company To Sell Final Expense Insurance For

Best Life Insurance To Cover Funeral Expenses